During the past several decades, owed to students has grown significantly in the United States. The Federal Reserve estimates that Americans owe $1.73 trillion in student loan debt in the second quarter of 2021. The record-breaking quarterly total represents a 3% jump from the second quarter of 2020 despite the government’s pause …

Read More »Consolidating your federal education loans: It will modify your payments

A Direct Consolidation Loan allows you to consolidate (combine) multiple federal education loans into one loan. The result is a single monthly payment instead of multiple payments. Loan consolidation can also give you access to additional loan repayment plans and forgiveness programs. There is no application fee to consolidate your …

Read More »What to do if you’re denied student loan refinancing

Refinancing your student loans could save you money and it only takes a few minutes to get personalized quotes from lenders. The Federal Reserve predicted that they’d keep their interest rates low through 2023, which means you may have time to prepare to refinance your student loans. If you don’t qualify …

Read More »Student Loan Consolidation: What Is It? Who Can Help You?

Student Loans Consolidation Getting an education is an expensive endeavor, and afterward, whether you graduate or not, repaying the loans you took out can prove to be quite challenging. Before you default, or ask for forbearance, or go as far as bankruptcy a common solution to help make your loan …

Read More »Are You Qualify for Student Loan Forgiveness or Discharge?

Federal student loans offer benefits – One benefit is the ability to qualify for loan forgiveness under special circumstances, the federal government may forgive part, or all, of your federal student loans. That means you’re no longer obligated to make your loan payments. Another benefit is there may be some …

Read More »Student Loan Balance Up After Five Years

Here’s what you need to know. A new report says that about half of student loan borrowers have a higher student loan balance after 5 years. Student Loan Repayment Imagine this common scenario: you borrow student loans. You start to pay off your student loans. You keep paying off your student loans every …

Read More »The complicated beauty of student debt forgiveness

Robert F. Smith, founder, and CEO of private equity firm Vista Equity Partners gave a commencement speech to Morehouse College’s graduating class. Then, the billionaire announced that he and his family would pay off the roughly 400 graduating seniors’ student loans — as well as loans taken out by students’ …

Read More »100,000 Debtors Rejected For loan forgiveness for student loans. But why?

Loan forgiveness for student loans Statistics- The latest student loan debt statistics show that more than 100,000 people who applied for public service loan forgiveness have been rejected. Here’s what you need to know and what to do about it. The U.S. Department of Education released the latest statistics for …

Read More »Denied public service loan forgiveness, so filed a lawsuit

The number of people who’ve been financially derailed by the public service loan forgiveness program is piling up, and so are the borrowers interested in bringing their servicers to court to seek damages.“It’s clear that students are claiming the servicers told them one thing, when something else was true,” said …

Read More »CFPB Student Loan Ombudsman Report

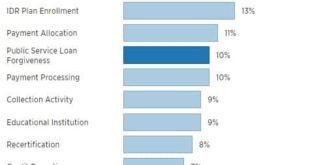

Executive summary Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, this annual report analyzes complaints submitted by consumers between September 1, 2016 and August 31, 2017. During this period, the Consumer Financial Protection Bureau (“CFPB” or “Bureau”) handled approximately 12,900 federal student loan servicing complaints, 7,700 private …

Read More » Student loan Forgiveness Call us immediately

Student loan Forgiveness Call us immediately