- The number of people who’ve been financially derailed by the public service loan forgiveness program is piling up, and so are the borrowers interested in bringing their servicers to court to seek damages.

- “It’s clear that students are claiming the servicers told them one thing, when something else was true,” said Dan Zibel, vice president and chief counsel at the National Student Legal Defense Network. “We believe they should have the right to go to court and seek redress for their loss.”

Source: Amanda Lawson-RossAmanda Lawson-Ross, Ph.D.

Amanda Lawson-Ross, a psychologist at the University of Florida, was in a government program in which public servants can get student debt canceled after 10 years.

Or so she thought.

Nearly seven years into her payments, she received a call from someone at Great Lakes, the company that serviced her loans for the U.S. Department of Education, who informed her that she didn’t actually qualify for public service loan forgiveness because she had the wrong loan type.

“I immediately broke down and just started sobbing,” Lawson-Ross said. “I had planned everything around this.”

She’s now suing Great Lakes.

The number of people who’ve been financially derailed by the public service loan forgiveness program is piling up, and so are the borrowers interested in bringing their servicers to court to seek damages, according to lawyers and consumer advocates.

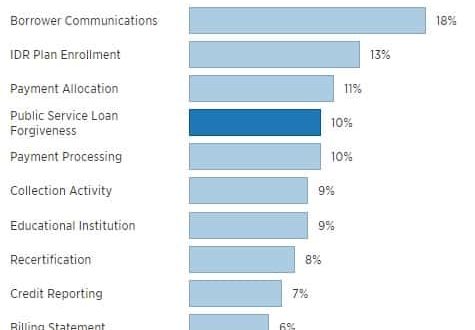

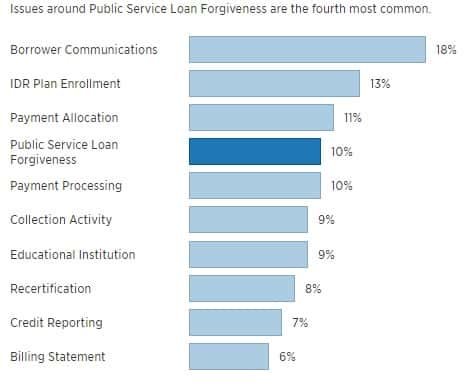

Top 10 student loan complaints

The public service loan forgiveness program was signed into law by President George W. Bush in 2007, and allows certain not-for-profit and government employees to have their federal student loans erased after 10 years of on-time payments. (For more requirement details, check out this previous CNBC story).

About 25 percent of American workers are in public service and could, in theory, be eligible.

However, student loan servicers are delaying and denying borrowers access to the forgiveness program, according to the Consumer Financial Protection Bureau. For example, Lawson-Ross said she spoke to staff at Great Lakes around 10 times to confirm that she was on track for the forgiveness.

“They told me, ‘Don’t worry about it. You’re good to go,'” she said. Had she known her loans didn’t actually qualify, she could have simply rolled them into a kind that did.

Great Lakes did not respond to an email request from CNBC for comment.

As a result of these problems, less than 1 percent of borrowers who’ve applied for loan forgiveness under the program so far have been approved, according to recent Education Department data.

“It’s clear that students are claiming the servicers told them one thing, when something else was true,” said Dan Zibel, vice president and chief counsel of the National Student Legal Defense Network. “We believe they should have the right to go to court and seek redress for their loss.”

Christie D. Arkovich, one of the lawyers handling Lawson-Ross’s case, said she’s been contacted by hundreds of other borrowers who claim their servicer misled them about the public service loan forgiveness program.

“As more people realize this isn’t their fault, more will want to challenge what has happened to them,” Arkovich said.

One of the biggest challenges these lawsuits face is that servicers argue that a federal law, the Higher Education Act, makes them effectively immune from the state consumer protection laws under which these cases are typically brought.

In Lawson-Ross’s case, for example, U.S. District Judge Mark E. Walker granted Great Lake’s motion to dismiss the case on the grounds that the Higher Education Act negated their state law claims. Although, the judge concluded, “This Court is troubled that this preemption may permit loan servicers’ misrepresentation without borrowers benefiting from full remedies.”

Lawson-Ross is appealing that decision, and she has a number of advocacy organizations behind her. “If mistreated borrowers cannot rely on state consumer protection laws, her only recourse is essentially to hope that the Department of Education takes action to hold their servicer accountable,” Zibel said.

The American Federation of Teachers, the second-largest teacher’s union in the U.S., has filed a “friend of the court” brief in support of Lawson-Ross. For the union, the case is personal.

Nine AFT members, composed of teachers, professors and other public servants, recently filed a lawsuit against Navient, alleging the company steered them away from public service loan forgiveness. The plaintiffs are seeking monetary damages and hope to change the company’s practices around the program, as well.

I immediately broke down and just started sobbing. I had planned everything around this.

–Amanda Lawson-Ross, a plaintiff in a lawsuit against Great Lakes

“The debate over pre-emption masks what is really at stake — millions of public employees who’ve dedicated their lives to helping others, only to be stripped of their right to loan forgiveness and the ability to enforce that right when their servicers defraud them,” said Randi Weingarten, president of the American Federation of Teachers.

Paul Hartwick, vice president of corporate communications at Navient, said the company informs borrowers about the main details of the public service loan forgiveness program. The company does not comment on ongoing litigation, he said.

Private Loan Guide And Review: What To Look For And Who To Consider

All About consolidation Student Loans

Getting An Education But At What Cost And Is It Worth It?

Student Loan Forgiveness program Plan and Options

Many of these lawsuits brought by student loan borrowers against their servicers will boil down to a he said-she said dispute, said Mark Kantrowitz, an expert in higher education law. “I’ve yet to hear from any borrower who can present documentation, such as email messages, or even contemporaneous notes, that support their claim that the lender lied,” Kantrowitz said.

Moreover, he said, it’s unclear whether companies like Navient even have a legal obligation to inform borrowers that their loans do not qualify for public service loan forgiveness. “The lender’s fiduciary duty is to the U.S. Department of Education and the lender’s investors, not the borrowers,” he said.

Student Loan Consolidation 2018: What Is It? Who Can Help You?

Various means and ways of dealing with student loans

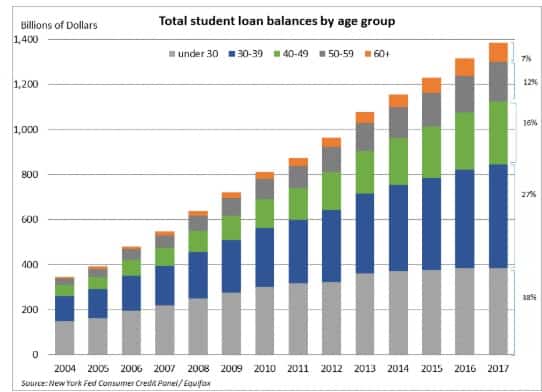

In 2018, Americans over the age of 50 owed more than $260 billion in student debt

However, Gus Centrone, a consumer lawyer in Florida, said student loan servicers position themselves as the main source of information for borrowers and therefore do have a responsibility to provide comprehensive and accurate advice. Like Arkovich, he has received calls from hundreds of borrowers who’ve run into problems with the public service loan forgiveness program, he said.

Centrone is involved in a lawsuit against Navient, which seeks to become a class action. If the case is successful, he said, at least tens of thousands of public servants could be eligible for damages.

Student loan Forgiveness Call us immediately

Student loan Forgiveness Call us immediately