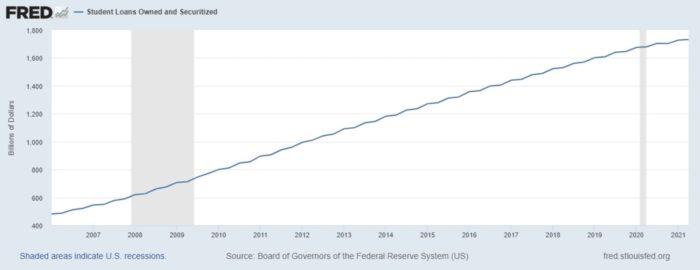

During the past several decades, owed to students has grown significantly in the United States. The Federal Reserve estimates that Americans owe $1.73 trillion in student loan debt in the second quarter of 2021.

The record-breaking quarterly total represents a 3% jump from the second quarter of 2020 despite the government’s pause on federal loan interest rates and the government’s elimination of billions in federal student loans.

It is even more evident that student debt has risen by more than 91% in the past decade when compared to decades prior. In quarter two of 2011, about $905 billion in student loans were owed by Americans. Which was an increase of more than 91% over the prior decade.

WalletHub compared the 50 states and the District of Columbia using 11 measures of indebtedness (average student debt amounts) and income opportunities (unemployment rate among recent graduates) to analyze which states struggle with student debt the most.

According to data, students from West Virginia have some of the highest ratios of student debt to income (even after accounting for costs of living in the state). Furthermore, student loan default rates are high in the state.

According to WalletHub, New Hampshire is the second-worst state for student debt holders, due to its high average owed to students totals and a high percentage of students with student debt.

According to a 2020 report from The Institute for College Access and Success, California and Utah have some of the least serious student debt problems. New Hampshire was identified as having a significant student debt problem.

New Hampshire residents in the college Class of 2019 owe the most in student debt, with an average of $39,410 – the most of any state.

“Students’ borrowing and debt differ greatly among states and colleges due to the differences in state and institutional policies, as well as the state’s investment in public colleges”.

Oliver Schak, TICAS research director, tells CNBC Make It that statewide average debt levels range from $17,950 (Utah) to $39,400 (New Hampshire) for graduates in the Class of 2019. “Students are also at varying risk of graduating with student debt in different states, with more than half of graduates leaving with student debt in 38 states.”

Schak explains that student debt borrowing levels have tended to be highest in “certain states and regions” in recent years. According to him, North-East states like Pennsylvania, New Jersey, and Massachusetts are high-debt states, while West coast states like California, Washington, and Arizona have lower debt levels.

Based on our 15-year trend analysis, Pennsylvania, New Jersey, and Massachusetts have experienced the greatest increases in debt from 2004 to 2019,” he adds. “Eight of the ten states appear to be in the same boat as previous years.”

Organizations such as the Federal Reserve Bank of New York and TICAS have published research that suggests how much states invest in public higher education – and by extension, lower prices – is the most significant driver of student debt differences between states.

Researchers report that, in low-debt states such as California, standards are also set for default rates and graduation rates to motivate schools to keep their debt loads under control.

Additionally, Schak points out that need-based financial aid and state grant aid programs, such as California’s Cal Grant program, can reduce net costs and limit borrowing. Rather than selecting students based on their merit. California awards state grant aid to needy students, limiting the amount that low-income students need to borrow.

The range of student debt by the state also highlights recent discussions about student debt forgiveness and who might benefit most from it.

“The average debt owed by borrowers varies considerably by state. but it’s worth noting that states that would see the highest return on broad-based debt cancellation may be the ones with the lowest average balances,” says Charlotte Hancock, senior director at the youth-centered research and advocacy group Generation Progress. “Borrowers with low balances face the highest repayment hurdles due to the likelihood that they will default on their debt and the likelihood that their salaries will allow them to repay it.”

The majority of borrowers with student debt under $10,000 are likely to go into default. By enacting a student loan forgiveness policy that eliminated up to $50,000 in student loans (proposed by some Democrats), states with larger average loan balances could theoretically have more funds forgiven per borrower.

Hancock emphasizes that canceling student debt would benefit everyone. “No matter where they live.”

Student loan Forgiveness Call us immediately

Student loan Forgiveness Call us immediately